Examining Bitcoin ETF Decision

United States SEC - Securities and Exchange Commission on Friday casted the ruling of Bats BZX Exchange's rejection on their proposed ruling for changing the list and Coin ETF trade. We will be examining in this article the reason behind the Securities and Exchange Commission's decision as well as the reactions of Bitcoin Community.

Details of SEC's Rejection

Inconsistencies on Exchange Act Section 6(b)5 is one of the grounds why SEC rejected the proposal of rule changed which states about requirements and other things on ruling will allow the national securities exchange be designated for the prevention of fraud and manipulation acts and practices and protecting investors as well as the public interest.

For them to be able to be consistent, SEC explained about the Exchange Act that :

1. There should be agreements on surveillance-sharing with trading significant markets of Bats BZX Exchange in its directives and Bitcoins.

2. Regulate Bitcoin market is a must.

On the other hand, Friday's Order says :

We all know that markets of Bitcoin are unregulated largely, that's the basis of SEC's conclusion on Bats BZX Exchange that doesn't have also and may not be able to have the kind of agreement that is surveillance-sharing which all other Securities and Exchange Commission-approved ETP or exchange-traded-products have commodity-trust.

SEC claims about the agreements will help on addressing speculation about potentiality of fraud and acts of manipulation and market practices. Without the following details, there has been inconsistencies on Section 6b5 of the Exchange Act.

Comments Letters - Inconsequential

As of 8th of March, they (the Commission) were receiving Fifty-nine comment letters on the proposal according to them. The 15-page has been directed by an Order of 38-page for comment discussions which has been received by the Securities and Exchange Commission, which being regard as grouped into comments; the Bitcoin of market worldwide, the Gemini exchange, and the Bitcoin derivative markets.

Professor Bitcoin also known to be Mark T. Williams commented on Bitcoin commuinity, and as a member of Boston University faculty which specialized in banking, risk in commodity trading and capital markets. The professor is known for his prediction in the last quarter of 2013 that there will be a failure of Bitcoin and down to below 10USD by June of 2014. Though he isn't right on his claim to these days, he is still standing by the idea that there will be a bubbly deflation of Bitcoin and insisted that he will be vindicated.

On that regard, the Commission was citing Williams multiple times in their ruling so probably his comments is on top of the others. He addressed the SEC that there's a lot of flaws in making Bitcoin fundamental of asset class in forcing into a structure of ETF.

He also told the Commission to reject the ETF and tried to convince them with telling the problems of volume of shallow trade, low liquidity, extreme hoarding, high bankruptcy risk and no regulation oversight like China and more.

The approval and disapproval though doesn't have to be lighted from these comments according to the Commission in their writing.

Bitcoin Community Reactions

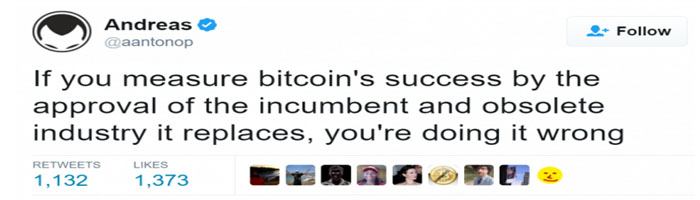

After the decision, Bitcoin community burst comments in social media. The actual reasons why it has been rejected and disapproved by the Commission is because of the inconsistencies in changing the rule of Coin ETF where doesn't resonate that good in the community.

Popular speaker of Bitcoin Andreas Antonopoulos tweets : “The ETF was denied because bitcoin can’t be regulated, can’t be surveilled. Feature, not bug”

Ben Davenport also CTO of Bitgo tweets with his interpretation of the activity : “SEC: bitcoin must be traded on regulated markets to be traded on regulated markets”

Senior Advisor Michael Casey at MIT Media Lab tweeted : “SEC rejection of #Bitcoin ETF means the space remains interesting. For now, BTC stays in the zone of disobedience. Where innovation happens”.

Hopes For BTC ETF in the Future

While Coin ETFs proposal has been rejected by the SEC, BTC ETF has still hope. Commission wrote :

"Bitcoin is still in the relatively early stages of its development and that, over time, regulated bitcoin-related markets of significant size may develop. Should such markets develop, the Commission could consider whether a Bitcoin ETP would, based on the facts and circumstances then presented, be consistent with the requirements of the Exchange Act."

The next SEC deadline of Bitcoin ETF is on March 30 on Solidx Bitcoin Trust . The next of that one is Bitcoin Investment Trust of Barry Silbert which is up on October this year.